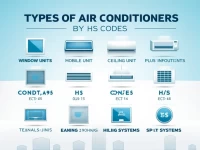

WCO Introduces App to Simplify Global Trade Compliance

The World Customs Organization (WCO) has launched the 'HS Browse & Check' App, providing customs professionals and international trade enthusiasts with convenient HS code lookup and regulatory interpretation services. This free app offers the complete HS2022 content, including legal notes, explanatory notes, and classification opinions, helping users efficiently conduct trade operations and make informed decisions. It aims to streamline international trade processes by providing readily accessible information on HS codes and related regulations.